WEEKLY BOND MARKET REPORT, FRIDAY JANUARY 23, 2026

Kenya's Shilling Holds Steady at 129.03 Against the Dollar While Bond Markets Surge and Interest Rates Drop to 9%: Here's What It Means for Your Money!

MARKET OVERVIEW

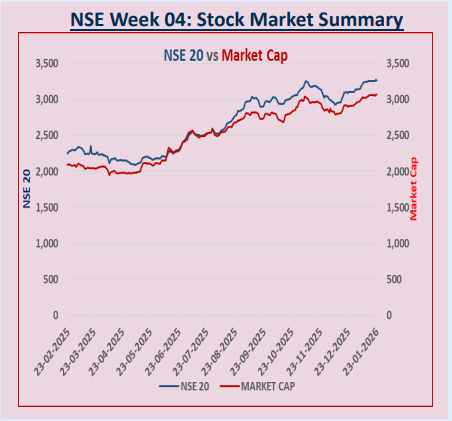

During the week ended 23rd January 2026, the market showed a robust performance in the bond market, equities, derivatives, Eurobonds and the international market.

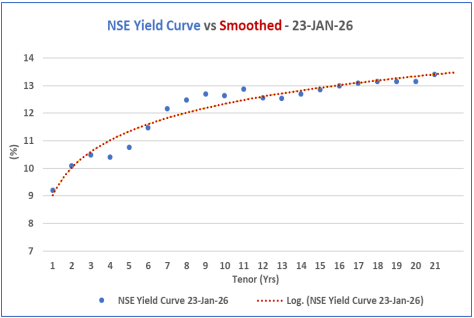

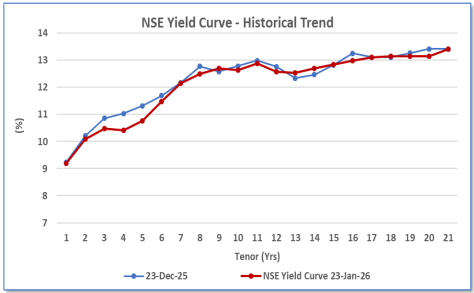

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 -year horizon while remaining relatively stable in the short-term and a relative decline in the long-term end.

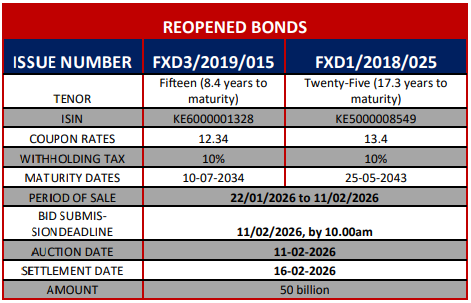

CBK broadcasted the prospectus for the reopened 15-year and 25- year fixed-coupon Treasury bonds; FXD3/2019/015 and FXD1/2018/025 with the bid submission deadline being 11th February 2026.

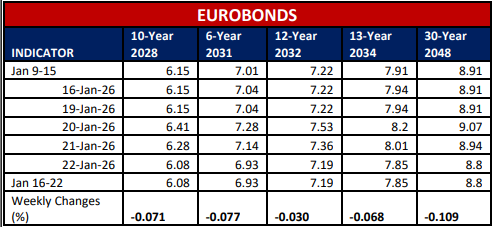

Yields on Kenya’s Eurobond declined for the third consecutive week by an average of 7.10 basis point compared to the previous week. The Eurobonds performed generally low all over the continent.

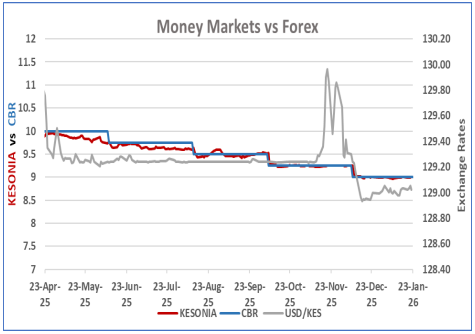

The Kenya Shilling remained stable against major international and regional currencies during the week ending January 23, 2026. It exchanged at KES 129.03 per U.S. dollar on average for the week.

The Monetary Policy Committee lowered the Central Bank Rate (CBR) to 9.0% at its December 9, 2025 meeting. This affects all related factors including the KESONIA ands lending rates expected to lower. The next MPC meeting is scheduled in February.

International oil prices declined over the week. Murban crude oil traded at USD 64.10 per barrel on January 23, from USD 64.31 per barrel on January 15 due to increased draw-down of US oil inventories, amid elevated oil market concerns arising from heightened geopolitical risks.

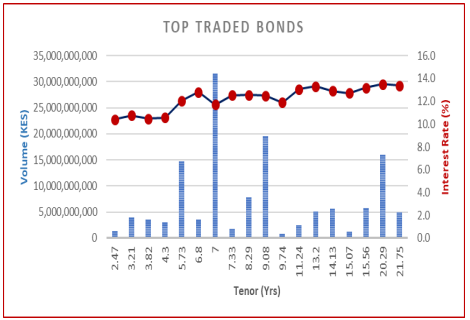

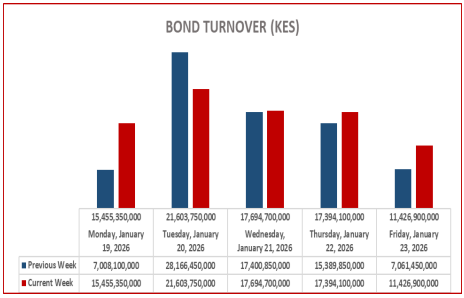

Bond turnover in the domestic secondary market increased for the second consecutive week by 11.4% closing at 85.7 billion.

INTEREST RATE OUTLOOK

Money Market Trends

The Kenya Shilling remained stable against major international and regional currencies during the week ending January 23, 2026.

It exchanged at KES 129.03 per U.S. dollar on January 20th , compared to KES 129.02 per US dollar on January 23th . On average the Kenyan Currency against the USD exchanged at KES 129.03 over the week.

Central Bank Rate (CBR) dropped to 9.00% from 9.25% following the Monetary Policy Committee (MPC) meeting held on 9th December 2025. This shows a trend of 25 basis points cut– rate for the past preview. The next meeting is scheduled in February.

KESONIA remained relatively stable at 8.98% on 23th Jan .

Short End of the Yield Curve and Inflation Trends

This week, T-bills witnessed undersubscription for the first time in a month, with an overall rate of 76.5%, down from 128.4% the prior week.

The 91-day paper saw an increased preference, attracting KES 1.4 billion in bids against KES 4.0 billion offered, leading to a subscription rate of 34.3%.

The 182-day paper's rate rose significantly to 88.3%, while the 364-day paper's rate dropped to 81.5%.

The government accepted KES 18.2 billion of KES 18.4 billion bids, resulting in a 99.2% acceptance rate.

Yields showed mixed results; the 91-day yield rose slightly by 2.6 bps to 7.7%, whereas the 182-day and 364-day yields decreased by 0.7 bps and 0.3 bps, remaining at 7.8% and 9.2%, respectively.

KENYA SECONDARY BOND MARKET TRENDS

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 -year horizon while remaining relatively stable in the short-term and a relative decline in the long-term end.

Week-on-week traded volumes have generally been consistent across the two week period with turnover spiking within the week, the turnover rose with a great margin for the week ended 23th January 2026.

KENYA PRIMARY BOND MARKET

Treasure Bond Auctions

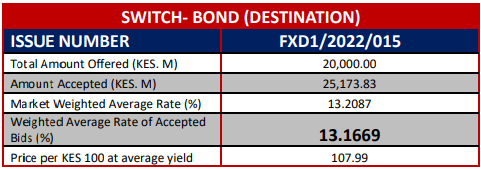

During the week, the Central Bank of Kenya announced the results of a treasury bond switch, exchanging FXD1/2016/010 for FXD1/2022/015. The bond switch was oversubscribed at a 132.5% subscription rate, with bids of KES 26.5 billion against an offer of KES 20.0 billion.

The government accepted KES 25.2 billion in bids, achieving a 95.0% acceptance rate, with a weighted average yield of 13.2% for the FXD1/2022/015. see table

This yield is lower than the previous rate of 13.9% from October 2025.

Reopened Bonds

CBK resumed the issuance of 15-year and 25-year fixed-coupon Treasury bonds, with the objective of raising KES 50 billion for budgetary assistance.

The 15-year bond (FXD3/2019/015) features a coupon rate of 12.34% and is set to mature in 2034, whereas the 25-year bond (FXD1/2018/025) provides a coupon rate of 13.40% and matures in 2043.

The deadline for bids is 11 February 2026, with the settlement date scheduled for 16 February 2026.

INTERNATION BOND MARKETS

U.S. Treasury yields rose sharply, with the 10-year yield peaking around 4.30%, influenced by global risk repricing and Japanese bond market volatility. The 30-year yield approached 4.9%, while investment-grade corporate bond spreads tightened to their lowest since 1998, indicating strong demand despite market fluctuations.

UK gilt yields rose modestly, reflecting U.S. yield pressures, and German Bond yields increased amid global shifts.

Japanese Government Bonds saw historic increases driven by fiscal policy changes, causing international yield impacts.

In China, monetary easing and government bond issuance affected market dynamics, with ongoing adjustments in U.S. Treasury holdings.

KENYA EUROBOND MARKET

Yields on Kenya’s Eurobonds performed relatively lower over the week.

On average, yields declined by average of 7.10 basis points across outstanding Eurobond issues. This suggests some downward price movement or rebalancing by investors in response to global market conditions.

In attachment, is the performance of the Daily Eurobond turnover for the week ended 23th January 2026 in graphical and statistical way.

BULLETIN BOARD

KPC Privatisation

The Government intends to divest a 65% interest in Kenya Pipeline Company by offering 11.81 billion shares at a price of KES 9 per share.

International Market

Chinese lending to Africa has significantly decreased, dropping from a high of approximately $28.8 billion in 2016 to roughly $2.1 billion at present.

NCBA Buyout

Nedbank Group of South Africa has proposed to purchase a controlling share of 66% of NCBA Group through a tender offer, which values the Kenyan bank at 1.4 times its book value.

The consideration for this acquisition is divided into 20% cash and 80% shares of Nedbank that are listed on the Johannesburg Stock Exchange.

Thus, NCBA will become a subsidiary of Nedbank which is headquartered at Johannesburg.

FOREX

Kenya's foreign exchange reserves decreased by USD 258 million this week, bringing the total to USD 12.219 billion, which is sufficient to cover 5.3 months of imports