Weekly Bond Market Report, Friday February 13 2026.

CBK Slashes Interest Rates to 8.75% for 10th Consecutive Time as Treasury Bonds Hit 427.5% Oversubscription, KCB and NCBA Cut Lending Rates, and Safaricom Launches Ziidi Money Market Fund Starting at Just Sh100!

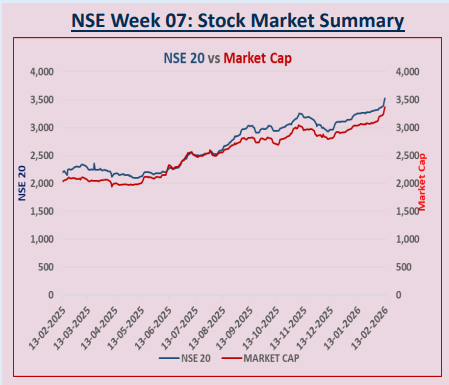

Market Overview

During the week ended 13th February 2026, the market showed a robust performance in the bond market, equities, derivatives, Eurobonds and the international market.

The Monetary Policy Committee (MPC) Lowered for the 10th consecutive series, the Central Bank Rate (CBR) to 8.75% from 9.00% during its meeting held on February 10th 2026. This observed the 25 basis point rate cut.

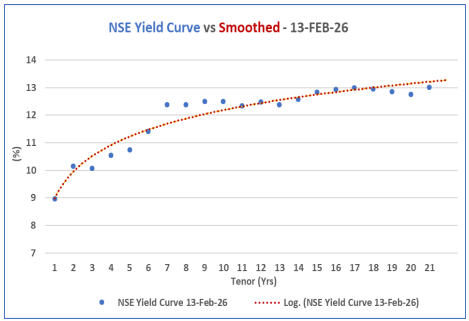

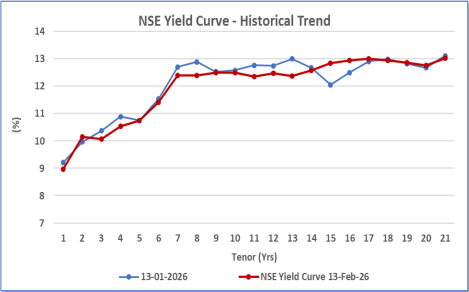

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 -year horizon while remaining relatively stable in the short-term and a relative shooting at the long term, partially influenced by the CBR rate cut

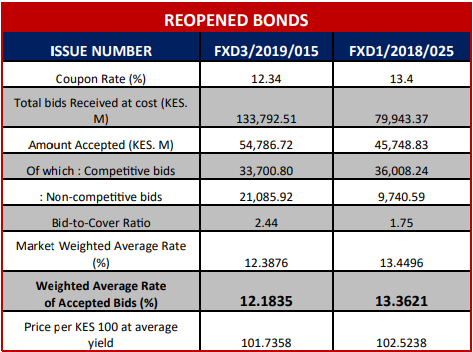

CBK released the results for the reopened 15-year and 25-year fixed-coupon Treasury bonds; FXD3/2019/015 and FXD1/2018/025. The auction experienced a high oversubscription of 427.5%

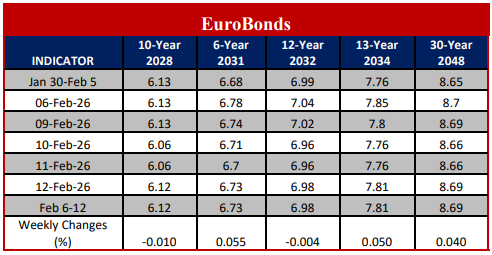

Yields on Kenya’s Eurobond increased by 2.08% during the week unlike last weeks downfall. The Eurobonds performed generally stable in most part of Africa.

The Kenya Shilling remained stable against major international and regional currencies during the week ending February 13th , 2026. It exchanged at KES 129.02 per U.S. dollar on average over the week.

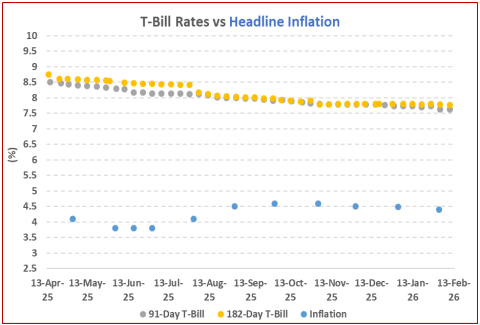

The Kenyan inflation lowered to 4.4% in January from 4.5% in December last year. This shows stability of the economy and the market.

International oil prices remained relatively stable with Murban oil trading at USD 68.50 per Barrel Bond turnover in the domestic secondary market ROSE over the week by 30.0% closing at 74.6 billion.

Interest Rate Outlook

Money Market Trends

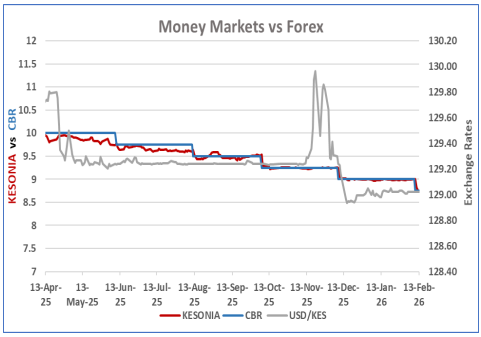

Central Bank Rate (CBR) dropped to 8.75% from 9.00% following the Monetary Policy Committee (MPC) meeting held on Tuesday, 10th February 2026. This shows a trend of 25 basis points cut– rate for the past preview. This comes after commercial banks recommended a retention. The rate cut will results to lower lending rates amongst many factors.

The Kenya Shilling has been stable for the past weeks with no aggressive fluctuations, most specifically against the US dollar.

It exchanged at KES 129.02 per U.S. dollar on February 9th , compared to KES 129.01 per US dollar on February 3rd . On average the Kenyan Currency against the USD exchanged at KES 129.02 over the week.

KESONIA declined to 8.78% on Friday 13th February

Short End of the Yield Curve and Inflation Trends

This week, T-bills saw an oversubscription rate of 308.8%, an increase from 267.8% the previous week.

The interest in the 91-day bill decreased, receiving KES 7.2 B in bids against KES 4.0B offered, resulting in a subscription rate of 179.5%.

However, the 182-day and 364-day papers saw subscription rates rise to 68.8% and 600.5%, respectively. The government accepted KES 44.8B of the KES 74.1B bids, yielding an acceptance rate of 60.5%.

Yields on government papers fell, with the 364-day yield decreasing by 22.4 bps to 9.0%, while the 91-day and 182-day yields changed minimally to 7.6% and 7.8%, respectively

Kenya Secondary Bond Market Trends

The NSE yield curve has generally edged upwards in the medium-term end 5 to 8 -year horizon while remaining relatively stable in the short-term and a relative shooting upwards in the long term papers.

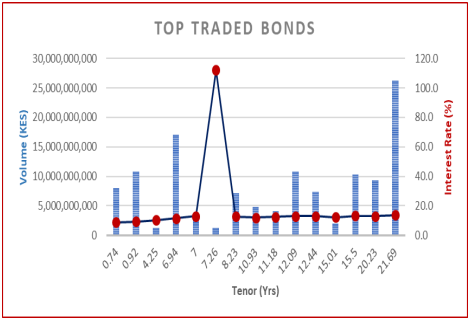

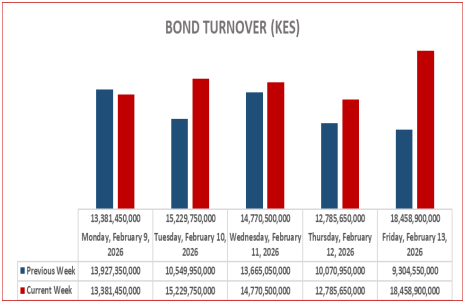

Week-on-week traded volumes have generally been consistent across the two week period with turnover spiking within the week, the turnover rose with a margin of 30% for the week ended 13th Feb 2026 compared to the previous week.

Kenya Primary Bond Market

Treasury Bond Auctions

The bonds experienced significant oversubscription at a rate of 427.5%, with bids totaling KES 213.7 billion against KES 50 billion offered.

The government accepted KES 100.5 B in bids, reflecting a 47.0% acceptance rate.

The weighted average yields for the accepted bids were 12.2% for FXD3/2019/015 and 13.4% for FXD1/2018/025, both lower than previous rates of 12.6% and 14.3%, respectively.

With an inflation rate of 4.4% in January 2026, the real returns are 7.8% and 9.0% for the bonds, and after accounting for a 10.0% withholding tax, the tax-equivalent yields are 12.9% and 14.2%, respectively.

International Bond Markets

U.S. Treasury yields fell across the curve over the week. The benchmark 10-year Treasury yield eased to around 4.05% by Friday (13 Feb) its lowest level since early December, as softer inflation data reinforced expectations for eventual rate cuts by the Federal Reserve. Markets priced in increased odds of rate reductions later in 2026, with traders moving further away from the “higher-for-longer” narrative. Short-term yields, including 2-year notes, also declined, reflecting this shift in expectations.

UK government bond yields (gilts) were generally modest to slightly softer during the week. The 10-year gilt yield eased to around 4.42% by Friday (13 Feb), slightly off recent levels, as markets balanced expectations of future monetary easing by the Bank of England against ongoing political uncertainty.

German Bund yields edged lower modestly over the week, tracking broader global bond moves. By mid-February, the 10-year Bund yield was near 2.75%, reflecting subdued inflation pressures in the Eurozone and markets pricing in unchanged policy from the European Central Bank in the near term.

Japanese government bond yields were relatively stable but with pockets of volatility following the recent snap election and fiscal policy discussions. The 10-year JGB yield remained around 2.21% by Friday and saw minor intra-week fluctuations as investors digested political developments that could influence fiscal spending and monetary policy.

China’s sovereign bond yields, including 10-year government bonds, showed modest upward pressure during the week as investors repositioned ahead of key policy meetings and broader market dynamics. Global shifts in risk sentiment and liquidity considerations influenced Chinese bond markets alongside domestic economic indicators.

Kenya Eurobond Market

Yields on Kenya’s Eurobonds performed well this week compared to previous week.

On average, yields increased 2.08% that is 2.63 Basis points on average. This suggests some upward price movement or balancing by investors in response to global market conditions.

In attachment, is the performance of the Daily Eurobond turnover for the week ended 13th February 2026 in statistical way.

Bulletin Board

KPC Privatisation.

The Government intends to divest a 65% interest in Kenya Pipeline Company by offering 11.81 billion shares at a price of KES 9 per share.

The IPO details are

The IPO closes on 19th February 2026 the coming week.

CBR Rate Cut

For the tenth consecutive reduction since August 2024, the CBK has lowered the policy rate by 25 basis points to 8.75%. With a total lowering of 425 basis points, rates have fallen to their lowest point since the beginning of 2023.

NCBA has already revised its Lending rate with their new facilities booked from 12 February applying the revised version rate of 8.75%.

Similarly KCB bank has reduced its base lending rate of 8.75%

Regional Market.

Uganda's central bank has maintained its policy rate at 9.75%, referencing inflation rates below the 5% target, stable exchange rate conditions, and a reduction in global price pressures in its Monetary Policy Statement for February 2026.

Launch of Ziidi

Safaricom launched Ziidi Money Market Fund (MMF) allows M-Pesa customers to invest in a money market fund from as low as KSH 100 from their M-Pesa and earn competitive daily interest.

Ziidi MMF is a simple and secure way for Kenyans to invest and grow their wealth through M-PESA. With low barrier to entry, competitive interest rates and seamless integration with M-PESA, Ziidi is a big step towards financial inclusion and investment accessibility in Kenya.