2025-NOV-7 MARKET REPORT

The Nairobi Securities Exchange (NSE) is on the brink of history, closing the week at a valuation of KES 2.991 Trillion—just shy of the 3 Trillion mark. Meanwhile, the fixed income market demonstrated robust health with bond turnover rising 7.9% to KES 40.9B and T-Bills recording a 5th consecutive week of oversubscription.

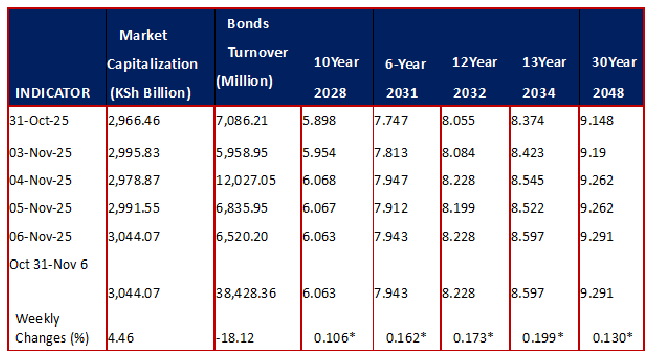

BOND MARKET

The domestic secondary bond market demonstrated robust performance, recording a turnover increase of not less than 7.9% for the week ended November 7,2025 compared to the other week’s performance. The total market turnover stood at Kes. 40.948 billion from Kes. 37.960 billion in the previous week.

Bond index recorded a 0.74% decrease to close the week at 1167.06 compared to 11.75.8 in the previous week.

During the week, the Central Bank of Kenya released the auction results for the re-opened treasury bonds FXD1/2012/020 and FXD1/2022/015 with tenors to maturities of 7.0 years and 11.4 years respectively and fixed coupon rates of 12.0% and 13.9% respectively.

Treasury bills were oversubscribed for the fifth consecutive week, with the overall subscription rate coming in at 166.1%, higher than the subscription rate of 101.1% recorded in the previous week.

In the international market, yields on Kenya’s Eurobonds decreased by 11.70% on average. The table below shows the performance of bonds domestically and internationally.

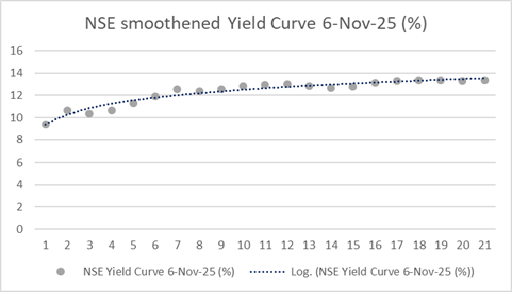

Below is a smoothened NSE curve as at 6th Nov 2025.

International Markets

Despite the Fed's rate cut, Treasury yields rose in the wake of the news and Chair Powell's commentary, suggesting a degree of hawkishness was priced in.

The 10-year Treasury yield closed the prior week around 4.08% and was largely range-bound during the week (between 3.95% and 4.20%).

As for the European bonds, Shorter-dated Bonds (Germany) and Gilts (UK) led returns in USD and CAD terms on a 1-month and year-to-date basis, partly due to the strength of the Euro and Sterling currency, and an improving inflation backdrop in the UK.

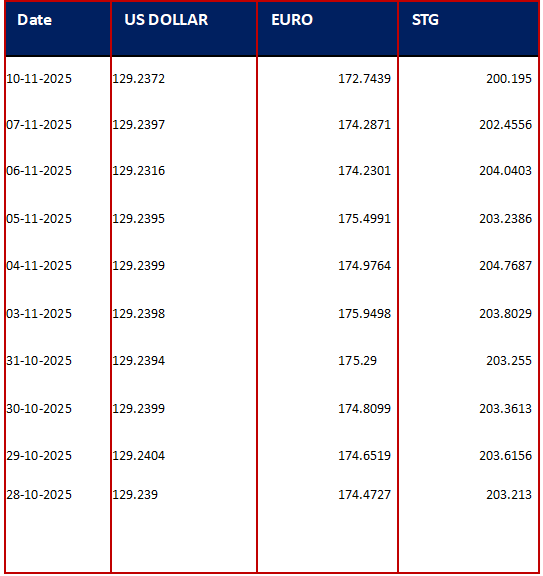

Exchange Rates

The Kenyan shilling showed remarkable stability against the USD. This was also the case against the Euro and Sterling Pound.

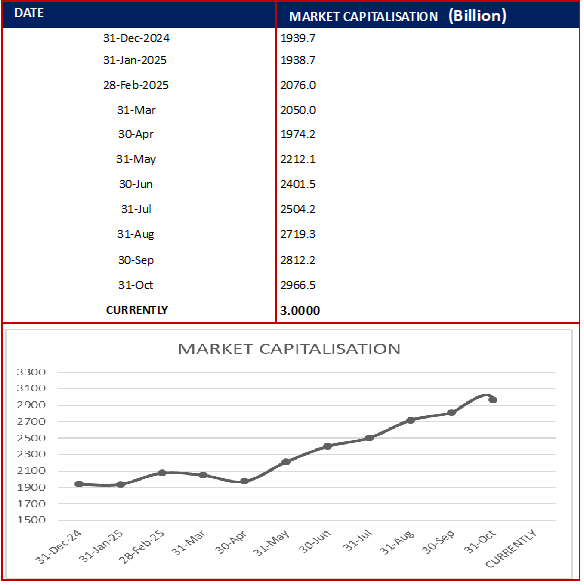

Market Share Statistics

The NSE valuation was on the verge of hitting a Sh3 trillion market capitalization for the first time in history. The Nairobi bourse closed at Sh2.991 trillion up from Sh2.473 trillion in mid-July- offering investors a return of half a trillion shillings in the period.

Inflation

The annual consumer price inflation as measured by the Consumer Price Index (CPI) was

4.6% as at September 2025. This implies that the general price level was 4.6% higher in September 2025 than it was in September 2024.