WEEKLY MARKET ANALYSIS, FRIDAY NOVEMBER 21, 2025

The Kenyan market displayed mixed signals this week as equities faced profit-taking pressures, particularly in the banking sector, while the fixed income segment saw massive oversubscription in Treasury auctions. The Kenya Shilling remained stable against the dollar, supported by robust remittances. Inside: Full analysis of the FXD1/2022/025 bond reopening and Eurobond yield trends.

Executive Summary

The Kenyan market for the week ended 21st November 2025 showed a mixed performance, characterized by stabilization in the debt and currency markets alongside a moderate pullback in equities due to profit-taking.

As for Friday 21st November 2025, the NSE experienced a mixed to slightly negative week, with both the NSE All Share Index (NASI) and the benchmark NSE 20 Share Index closing marginally lower. This decline was largely attributed to profit-taking in previously rallying large-cap banking stocks like Equity Group Holding. The selling pressure from foreign net investors was counteracted by strong participation from domestic investors, who provided crucial market stability. Safaricom Plc continued to dominate turnover despite a slight easing in its share price targeting to issue a bond in the near future.

The total market capitalization stood at approximately KES 2.96 trillion by the end of Friday 21st November.

In the Fixed Income Market, there was continued strong appetite for short-term government securities, with the weekly Treasury Bill auction showing high subscription rates and stable weighted average interest rates. Kenya's sovereign Eurobonds exhibited an improvement in pricing in the international market, suggesting improving international investor sentiment regarding the country's fiscal outlook.

The Kenya Shilling displayed broad stability against the US Dollar, trading around KES 129.25. This stability was supported by continued, albeit minor, foreign exchange inflows, adequate official forex reserves that met the CBK's import cover requirement, and robust remittance inflows.

Inflation is well contained and stable standing at 4.6% as at October 2025.

International Market

Compared to last week, International oil prices rose marginally on account of oil inventories draw-down. Murban oil price rose marginally to USD 65.25 per barrel on November 20, from USD 65.03 per barrel on November 13

The dollar has once gain been firm and stable, supported by resilient US growth that has tempered expectations for near-term Federal Reserve (Fed) rate cuts. However, a base case for many analysts is that the USD will likely weaken over the coming year as US growth is expected to slow and the Fed's policy may ease, compressing the USD's yield advantage compared to other stable or tighter central banks.

As of November 21, 2025, Kenya's Eurobonds are trading on the backbone of significantly improved fundamentals and liquidity following a successful liability management exercise, despite short-term volatility stemming from the wider global risk appetite. It performed much better compared to the other week. See Table 1

10-Year 2028 | 6-Year 2031 | 12-Year 2032 | 13-Year 2034 | 30-Year 2048 | |

|---|---|---|---|---|---|

Nov 7-13 | 6.054 | 7.869 | 8.114 | 8.503 | 9.191 |

14-Nov-2025 | 6.052 | 7.936 | 8.201 | 8.602 | 9.219 |

17-Nov-2025 | 6.051 | 7.867 | 8.115 | 8.529 | 9.176 |

18-Nov-2025 | 6.108 | 7.9 | 8.201 | 8.628 | 9.219 |

19-Nov-2025 | 6.225 | 7.967 | 8.23 | 8.653 | 9.248 |

20-Nov-2025 | 6.103 | 7.896 | 8.173 | 8.631 | 9.22 |

Nov 14-20 | 6.103 | 7.896 | 8.173 | 8.631 | 9.22 |

Weekly Changes (%) | ▲ 0.049 | ▲ 0.027 | ▲ 0.058 | ▲ 0.127 | ▲ 0.029 |

Source: CBK Statistics

Bond Market

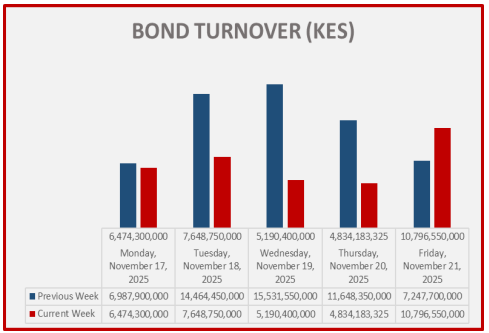

Bond turnover in the domestic secondary market decreased by 46.09% during the week ending November 21, 2025 . In the international market, yields on Kenya’s Eurobonds increased by 5.82 basis points on average.

Below is the performance of the bond turnover for the week ended 21st November in graphical and statistical way.

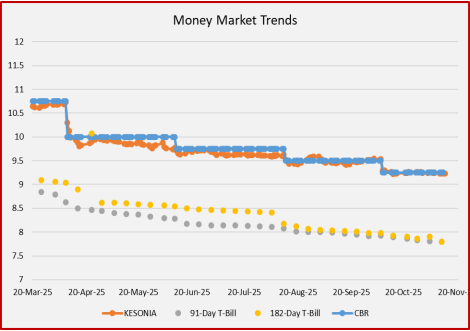

Also see the performance of the Treasury Bills— 91 days and 182 days, in attachment with KESONIA and Central Bank Rates (CBR)

Table 2

Treasury Bills

This week, T-bills were oversubscribed for the seventh consecutive week, with the overall subscription rate coming in at 180.9%, lower than the subscription rate of 129.1% recorded the previous week.

Interest rate on the 91– days Treasury bill declined marginally which contrasts the 182– days and the 364-days Treasury bill The Treasury Bill auction received bids worth KES 43.4 billion against an advertised amount of KES 24 billion. This is described by table 3

Treasury Bonds The Central Bank of Kenya reopened the FXD3/2019/015 and FXD1/2022/025 treasury bonds, with coupon rates of 12.34% and 14.88%, respectively.

Bid submissions closed on November 19, 2025. Results were released the same day, showing a huge oversubscription on the bonds.

The accepted rates for FXD3/2019/015 and FXD1/2022/025 are 12.57% and 13.75% respectively.

The bond market showed a relaxed activities this week. 31.4 Billion which shows an immense dip down of 46.0% fall compared to last week. See table 4;

Table 4

ISSUE NUMBER | FXD3/2019/015 | FXD1/2022/02 5 |

|---|---|---|

TENOR | 8.7 years to maturity | 21.9 years to maturity |

ISIN | KE6000001328 | KE8000005093 |

Total bids Received at cost (KES M) | 33,714.18 | 82,144.11 |

Performance Rate (%) | 84.29 | 205.36 |

Amount Accepted (KES M) | 20,188.58 | 34,572.16 |

Bid-to-Cover Ratio | 1.67 | 2.38 |

Market Weighted Average Rate (%) | 12.7456 | 13.8482 |

Weighted Average Rate of Accepted Bids (%) | 12.5736 | 13.746 |

Price per KES 100 at average yield | 103.0202 | 104.3685 |

Coupon Rate (%) | 12.34 | 14.188 |

International Bond Market

Based on the provided document, Kenya's international bond market (Eurobonds) exhibited the following performance in the preceding period .Kenya's sovereign bonds traded in the international market (Eurobonds) generally showed an improvement in pricing.

Yields on Kenya's Eurobonds were decreasing slightly on average in the period preceding the end of the week. This decrease in yields suggests improving international investor sentiment regarding Kenya's debt sustainability and fiscal outlook

EQUITIES

The market capitalization this week lowered in performance compared to the last week. NSE had attained 3 Trillion ever in history.

The market cap this week closed at KES 2,965.53 Bn which shows a slight improvement of 0.26% compared to KES 2957.95 Bn of the previous week.

See table 5

Table 5

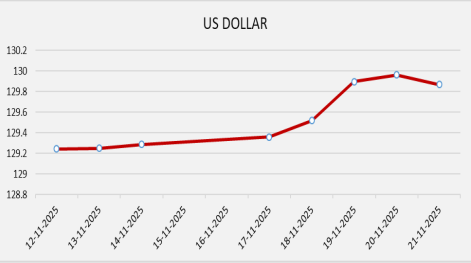

Exchange rates

The Kenya Shilling remained stable against major international and regional currencies during the week ending November 14, 2025. It exchanged at KES 129.96 per U.S. dollar on November 20, compared to KES 129.25 per US dollar on November 13

It also performed against the Euro, Chinese Yuan, pound and many more

Below is the performance of US dollar against Kenya Shilling. It indicate that there is stability of KES against the dollar. Table

General Market Overview

The NSE 20 Share Index eased by approximately 0.69% for the week

Total market capitalization stood at approximately KES 2.96trillion by the end of Friday.

Safaricom Plc dominated activity and turnover, but its share price eased slightly due to profit-taking.

Treasury Bills: The weekly auction (bids closed on November 20, 2025) showed a sustained strong appetite for short-term debt, leading to high subscription rates. The weighted average interest rates for the 91-day and 364-day T-Bills were largely stable or saw minimal fluctuations.

Eurobond and International Market: Kenya's sovereign bonds generally exhibited an improvement in pricing.

KES vs. USD: exchanging at approximately KES 129.25 per U.S. dollar around this time.

Inflation: The most recent headline inflation figure remained contained, at 4.6 as at October 31. .

Derivatives Market (NEXT): The NSE Derivatives Market saw low but active trading, with continued activity noted in the Index Futures (N25I) contracts

Other News

Kenya retires KES 20.08 Bn in an overbid Buyback of FXD1/2023/003.The CBK accepted the KES 20.08 Bn successfully retiring a portion of the government’s domestic debt ahead of its maturity in May 2026.

Majority of the commercial bank released their financial reports for the stakeholders consideration. Major banks like; ABSA, Equity, KCB, Standard Chartered Bank showed a better performance compared to the previous years statistics.

Safaricom Plc intends to raise 40 Billion by issuing a corporate bond. The issue process is underway. The news were publicized by the CEO on Wednesday